Analysis of Financial Indicators of Listed Companies ——A Case Study of Aonong Group

Zhiqian Zeng1,a, Xinglin Li1,b,*, Xudong Chen2,c

1Jilin University of Finance and Economics, Changchun, Jilin, China

2Macau University of Science and Technology,Avenida Wai Long,Taipa,Macau

Abstract.

With the rapid development of Chinas economy, animal husbandry has become an indispensable industry in Chinas economic development. Both the number of poultry raised and the output of products have increased significantly compared to before. Chinas animal husbandry is gradually moving towards regionalization, industrialization, and scale. This requires the states support for animal husbandry in terms of policy, financial guarantee, and personnel training. At present, Chinas livestock industry accounts for about 30% of the primary industry, and it has become an important pillar of the primary industry. Because of this, it is particularly important to analyze the financial statements of agricultural groups engaged in animal husbandry. This article takes the financial statements of Aonong Group listed on the Shanghai Stock Exchange from 2014 to 2018 as an example for financial analysis.

Introduction

Aonong Group, full name is Fujian Aonong Biotechnology Group Co., Ltd. Established in April 2011, it is a high-tech agricultural and animal husbandry company led by standardization, intensification, and industrialization. It has more than 4,500 employees and more than 100 subsidiaries, covering 31 provinces, municipalities and autonomous regions. Since the establishment of the company, it has always been aimed at becoming an industry leader.

At present, the company has further developed the agricultural Internet industry on the basis of existing pig raising, feed, animal health, raw material trade and other industries. In addition, Aonong Group is also actively seeking to make use of the advantages of market platforms to carry out multi- faceted industrial investment and mergers and acquisitions to enable enterprises to develop faster and better.However, analysis of the companys annual report data shows that compared with the previous period, Aonong Groups net profit attributable to shareholders of the parent company has decreased. Net profit from 2014 to 2018 decreased from 39.202 million yuan to 10.425 million yuan. Although the overall decline was not large, the net profit in 2018 decreased significantly from 2017, from 122 million yuan in 2017 to 10.425 million yuan in 2018 This article will analyze the relevant financial indicators of this phenomenon.

Accounting analysis

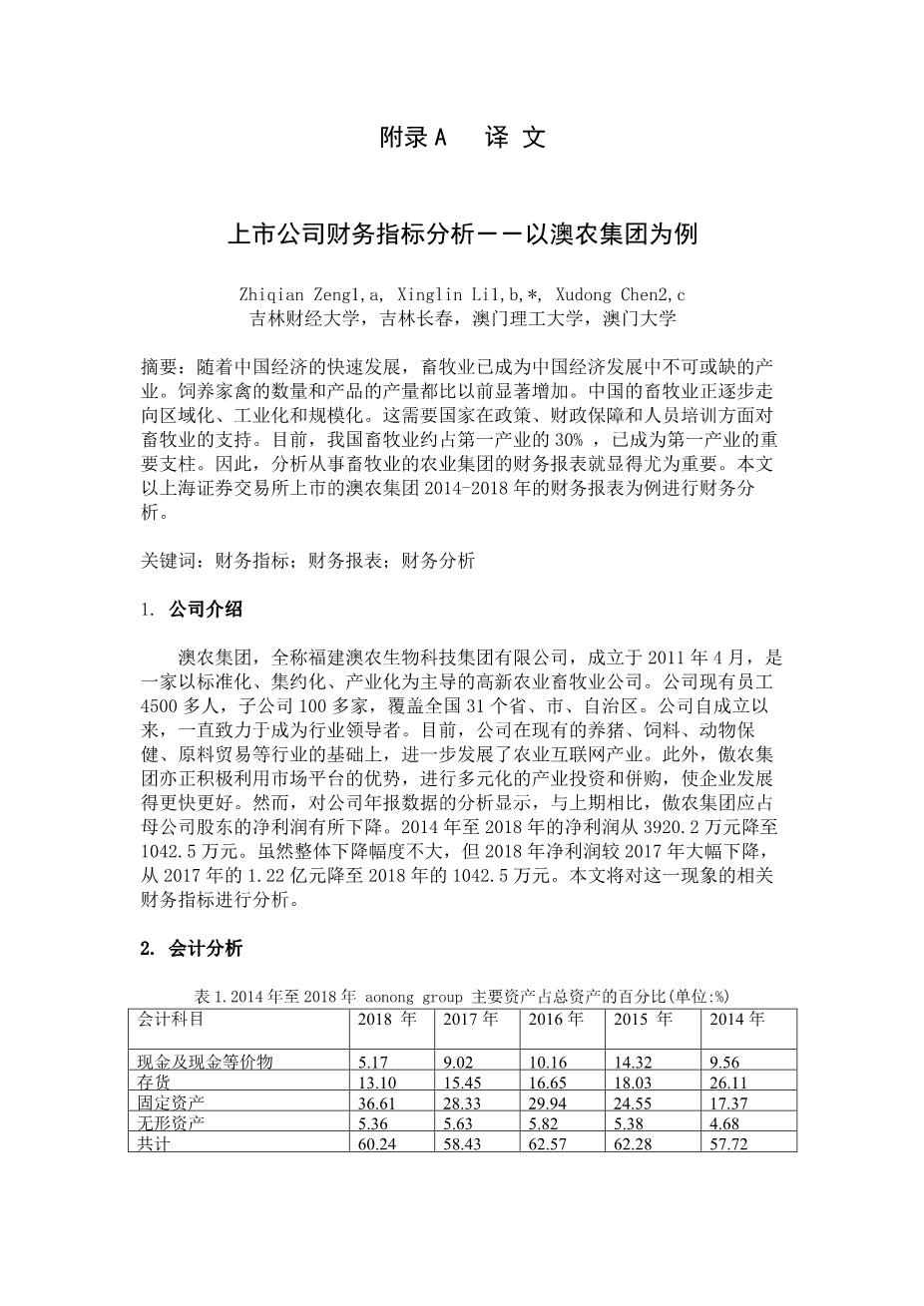

Table 1 Aonong Groups main assets as a percentage of total assets from 2014 to 2018 (Unit:%)1

|

Accounting Subject |

2018 year |

2017 year |

2016 year |

2015 year |

2014 year |

|

Cash and cash equivalents |

5.17 |

9.02 |

10.16 |

14.32 |

9.56 |

|

Inventories |

13.10 |

15.45 |

16.65 |

18.03 |

26.11 |

|

Fixed Assets |

36.61 |

28.33 |

29.94 |

24.55 |

17.37 |

|

Intangible Assets |

5.36 |

5.63 |

5.82 |

5.38 |

4.68 |

|

Total |

60.24 |

58.43 |

62.57 |

62.28 |

57.72 |

-

- Cash and cash equivalents

The large amount of monetary funds, on the one hand, means that the assets are highly liquid, which in turn increases the difficulty factor of management. On the other hand, enterprises hold monetary funds mainly for three reasons: transactional needs, preventive needs, and speculative needs. Holding large amounts of monetary funds indirectly explains to some extent that the company has not formulated a clear Investment plan, or no more suitable investment opportunities. The decentralization of funds will affect the future business plan of the enterprise, which will restrict its development. Strengthening the management of corporate funds and making better use of monetary funds are important to the long-term development of the enterprise. In 2018, the groups monetary funds as a percentage of total assets decreased from 14.32% to 9.56%, a decrease of 3.85%, which reflects the efficient use of funds to some extent. According to corporate announcements, it is located in Jiangsu Aonong and Jian Aonong woven bag bases. Waiting for the base to be put into operation has further increased the companys investment expenditure, supporting the previous speculation.

-

- Inventories

Inventory is affected by many factors, and its liquidity is strong. As can be seen from Table 1, the inventory of Aonong Group accounts for a large proportion of total assets. Aonong Group is a large- scale aquaculture industry. If the inventory is too low, it will reduce the sales volume of the enterprise, which will affect sales and operating income. However, the accumulation of inventory will cause a series of problems, such as the slowdown of product sales, which may cause the interruption of the capital chain, which will endanger the normal operation and strategic planning of the enterprise. The total inventory cost decomposition model is shown in Figure 1.

Order fixed cost:F1

Order cost

Acquisition cost

Order variable cost:?/?K

Purchase cost

Total cost

Fixed storage cost:F2

Storage cost

Variable storage cost:K2?/2

Shortage cost

Figure 1 Decomposition model of total inventor

剩余内容已隐藏,支付完成后下载完整资料

英语译文共 8 页,剩余内容已隐藏,支付完成后下载完整资料

资料编号:[602925],资料为PDF文档或Word文档,PDF文档可免费转换为Word

您可能感兴趣的文章

- 饮用水微生物群:一个全面的时空研究,以监测巴黎供水系统的水质外文翻译资料

- 步进电机控制和摩擦模型对复杂机械系统精确定位的影响外文翻译资料

- 具有温湿度控制的开式阴极PEM燃料电池性能的提升外文翻译资料

- 警报定时系统对驾驶员行为的影响:调查驾驶员信任的差异以及根据警报定时对警报的响应外文翻译资料

- 门禁系统的零知识认证解决方案外文翻译资料

- 车辆废气及室外环境中悬浮微粒中有机磷的含量—-个案研究外文翻译资料

- ZigBee协议对城市风力涡轮机的无线监控: 支持应用软件和传感器模块外文翻译资料

- ZigBee系统在医疗保健中提供位置信息和传感器数据传输的方案外文翻译资料

- 基于PLC的模糊控制器在污水处理系统中的应用外文翻译资料

- 光伏并联最大功率点跟踪系统独立应用程序外文翻译资料